Business Entertainment Deduction 2024 Limits – Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (April the standard deduction and itemized deductions, pick whichever one is higher. (Small business owners .

Business Entertainment Deduction 2024 Limits

Source : www.cainwatters.comExpanded meals and entertainment expense rules allow for increased

Source : www.plantemoran.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comPublication 463 (2023), Travel, Gift, and Car Expenses | Internal

Source : www.irs.govSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSignificant HSA Contribution Limit Increase for 2024

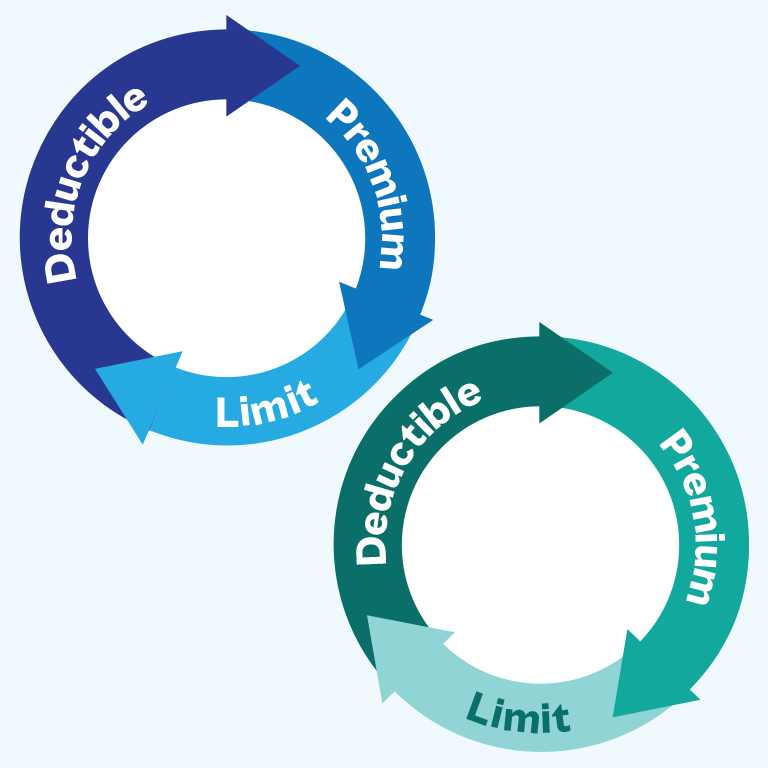

Source : www.newfront.comMarsh | Global Leader in Insurance Broking and Risk Management

Source : www.marsh.comShannon Williams Accounting Services 228•297•3426 | Saucier MS

Source : m.facebook.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coBusiness Entertainment Deduction 2024 Limits Meals & Entertainment Deductions for 2021 & 2022: there is need for the standard deduction limit to be increased from the existing Rs 50,000 to Rs 100,000 per annum. This move will also bring parity with those earning income from business or . 2024 retirement contribution limits as those accounts. The main difference is they are funded through payroll deductions. These accounts can be an attractive option for small-business owners .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)